What Are Tariffs, and Why Do They Matter for Irish Whiskey?

What’s a Tariff? Simplified for Whiskey Lovers and Industry Pros

A tariff is a tax that governments charge on imported or exported goods. Think of it like a “gate fee” for products crossing international borders. There are two main types:

- Ad valorem tariffs: Charged as a percentage of the product’s value (e.g., 10% of the bottle’s price).

- Specific tariffs: A flat fee per unit (e.g., $2 per liter of whiskey).

For example, if a €50 Irish whiskey bottle faces a 10% ad valorem tariff in the U.S., the importer must pay €5 extra in taxes before selling it. This cost isn’t just a number—it ripples through the supply chain.

Why Tariffs Are Critical to the Irish Whiskey Industry

The Irish whiskey industry thrives on global exports. In 2023, 90% of all Irish whiskey produced was shipped overseas, according to the Irish Whiskey Association (IWA). That means tariffs aren’t just a minor inconvenience—they’re a make-or-break factor for distilleries.

Tariffs directly impact profitability. If a distillery pays €1 million in annual tariffs, that’s €1 million less to invest in new barrels, marketing, or upgrading aging facilities. They also affect consumer prices: A 2022 IWA survey found that 60% of brands raised retail prices by 5–15% after Brexit-related tariffs took effect. Worse, high tariffs can block access to key markets. If a country slaps a 30% tax on Irish whiskey, smaller brands might struggle to compete with local spirits, limiting growth.

A Brief History of Irish Whiskey Tariffs

19th–20th Century: Tariffs and the Decline (and Revival) of Irish Whiskey

Tariffs have long shaped the Irish whiskey story. In the 1800s, British colonial policies imposed heavy taxes on Irish whiskey exports to its empire (including India, Australia, and South Africa). Meanwhile, Scotch whisky (note: “whisky” without an “e” is the Scottish spelling) faced lower tariffs, letting it dominate global markets. By 1900, Scotch outsold Irish whiskey 10:1.

Then came Prohibition in the U.S. (1920–1933), which banned alcohol sales entirely. Even after repeal, tariffs and trade restrictions lingered, keeping Irish whiskey out of the American market for decades. Production in Ireland plummeted—only 3 distilleries remained operational by the 1960s.

But the tide turned post-WWII. When Ireland joined the European Union (then the EEC) in 1973, tariffs within Europe vanished. Suddenly, Irish whiskey could flood markets in France, Germany, and Spain without extra taxes. By 2000, exports to Europe accounted for 40% of total sales, helping the industry rebuild.

The EU Era: How Single Market Rules Changed Trade

Before the EU, Ireland’s whiskey exporters paid steep tariffs to European neighbors. For instance, France charged a 20% ad valorem tariff on Irish whiskey imports in the 1960s. But EU membership transformed this: Under the single market, tariffs between EU countries dropped to zero.

This shift was game-changing. Brands like Jameson and Bushmills saw exports to Europe surge. By 2019, EU countries (excluding the UK) bought 35% of all Irish whiskey, with Germany alone importing over 10 million bottles annually. As one IWA historian noted, “EU integration didn’t just remove tariffs—it gave Irish whiskey a passport to the world.”

Brexit and the New Tariff Landscape (2020 Onward)

Brexit (the UK’s exit from the EU in 2020) flipped the script. Ireland, an EU member, now faces tariffs when exporting to its closest neighbor, the UK.

Under the Trade and Co-operation Agreement (TCA), tariffs on whiskey between the EU and UK remain 0%—but only if products meet strict “rules of origin.” For Irish whiskey, this means:

- At least 85% of the whiskey must be produced in Ireland (no blending with non-Irish spirits).

- All ingredients (like malted barley) must be sourced from Ireland or the UK/EU.

Even with zero tariffs, hidden costs emerged. Exporters now spend 2–3 hours per shipment on customs paperwork (up from 30 minutes pre-Brexit), and delays at ports like Dublin and Belfast Increased. A 2023 report by PwC found these non-tariff barriers cut Irish whiskey exports to the UK by 12% in 2022.

Current Tariffs on Irish Whiskey: A Global Breakdown

Let’s map where Irish whiskey faces tariffs today—and what those costs mean.

United States: Tariffs on Irish Whiskey Imports

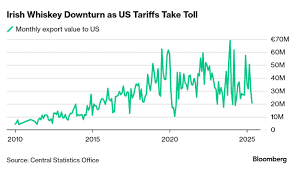

The U.S. is Ireland’s biggest export market, buying 20% of all Irish whiskey in 2023 (IWA data). But getting there isn’t cheap.

Under WTO rules, the U.S. charges a 2.5% ad valorem tariff on whiskey imports. However, states like California and New York add their own sales taxes (up to 10%), making total costs 12.5% higher for a €50 bottle.

Interestingly, Scotch whisky faces the same 2.5% tariff in the U.S. But Scotch benefits from stronger brand loyalty (70% of U.S. whiskey drinkers prefer Scotch, per a 2024 survey). Irish whiskey, while growing, still trails—tariffs make it harder to close the gap.

European Union (EU): Tariffs Within the Bloc

Within the EU, no tariffs apply to Irish whiskey. That’s thanks to the single market, which eliminates trade barriers between member states.

But what about EU neighbors? Ireland trades with EFTA countries (Norway, Switzerland, Iceland) under the EEA agreement, which also eliminates tariffs. However, non-EFTA countries like Turkey charge 15% ad valorem tariffs on Irish whiskey, limiting exports to that region.

United Kingdom (UK): Post-Brexit Tariffs Explained

While the TCA keeps tariffs at 0% for compliant Irish whiskey, the UK isn’t entirely tariff-free. For non-EU countries, the UK sets its own tariffs. For example, Irish whiskey imported into the UK from a third country (like Canada) would face UK tariffs on top of EU tariffs—but that’s rare, as most Irish whiskey is sold directly to the UK from Ireland.

The bigger issue? Rules of origin compliance. A 2023 IWA survey found 30% of small distilleries (producing <10,000 bottles/year) struggled to meet TCA requirements, forcing them to halt UK exports temporarily.

Emerging Markets: Tariffs in Asia, Africa, and Beyond

Emerging markets are a key growth area, but tariffs often block progress:

- China: Imports face a 10–15% ad valorem tariff plus a 17% VAT, totaling 27–32% extra costs. Despite this, Irish whiskey sales in China grew 8% in 2023, driven by luxury demand.

- India: A 10% ad valorem tariff plus a 15% excise duty makes Irish whiskey 25% more expensive than local brands. Exports here are minimal (~2% of total exports).

- UAE/Singapore: Low tariffs (0–5%) and duty-free zones have made these hubs for Irish whiskey. Exports to the UAE rose 22% in 2023, with Singapore close behind at 18%.

Table: Current Tariff Rates for Irish Whiskey (2024)

| Market Region | Tariff Type | Tariff Rate | 2023 Export Growth (%) |

|---|---|---|---|

| United States | Ad valorem | 2.5% | +7% |

| European Union | None (single market) | 0% | +11% |

| United Kingdom | 0% (TCA compliant) | 0% | -12% (non-compliant) |

| China | Ad valorem + VAT | 27–32% | +8% |

| UAE/Singapore | Ad valorem | 0–5% | +22% (UAE), +18% (Singapore) |

Who Pays for Tariffs? Producers, Exporters, or Consumers?

Tariffs don’t vanish—they’re passed through the supply chain. Let’s break down who feels the pinch.

The Producer’s Burden: How Tariffs Hit Distilleries

Distilleries (like Tullamore DEW or microbrands such as Dingle) absorb tariffs first. Small craft producers, with thin margins, suffer most.

For example: A craft distillery exporting 5,000 bottles/year to the U.S. at €50/bottle pays €6,250 in tariffs (2.5% of €50 x 5,000). That’s enough to cover 3 months of barrel aging costs. Larger brands (e.g., Pernod Ricard, which owns Jameson) can spread these costs across millions of bottles, but they still impact profitability.

As Seán Muldoon, CEO of Muldoon Distillers (a small Irish craft brand), told us: “Tariffs aren’t just a line item—they’re a threat to our survival. Every euro spent on taxes is a euro not spent on new recipes or marketing.”

Exporters and Distributors: Negotiating Costs

Exporters (companies that ship whiskey abroad) often negotiate with distilleries to split tariff costs. But they also face pressure from local distributors.

In high-tariff markets like India, exporters might reduce order sizes to avoid bulk duty fees. Instead of shipping 10,0000 bottles, they send 5,000—cutting costs but also limiting availability. Some even pivot to duty-free shops, where tariffs are paid upfront by the retailer, not the consumer.

One exporter, Celtic Trade Co., shared their strategy: “We focus on premium markets where consumers are willing to pay more. Tariffs on a €100 single malt are easier to absorb than on a €25 blended whiskey.”

Consumers: Do Tariffs Make Your Favorite Whiskey More Expensive?

Yes—ultimately, tariffs land on your shopping cart. A 2023 IWA report found that 60% of brands increased retail prices by 5–15% after Brexit tariffs.

Take a €50 bottle exported to the UK pre-Brexit: No tariffs, so UK retailers sold it for ~£45 (€50). Post-Brexit, even with 0% tariffs, customs delays forced brands to pad prices. Now, that same bottle costs £50–£55 in UK stores.

Tariffs also lead to “hidden costs.” To offset taxes, some brands reduce bottle sizes (e.g., selling 500ml instead of 750ml) or use cheaper packaging. A 2024 survey by Whiskey Enthusiast found 25% of Irish brands in high-tariff regions (like Brazil) had downsized bottles since 2020.

Irish Whiskey vs. Competitors: How Tariffs Stack Up

Tariffs aren’t unique to Irish whiskey—let’s see how it compares to Scotch, Bourbon, and others.

Scotch Whiskey Tariffs: A Closer Competitor’s Trade Barriers

Scotch and Irish whiskey face similar tariffs in many markets. For example, the U.S. charges 2.5% ad valorem on both. But Scotch benefits from:

- Stronger brand loyalty: 70% of U.S. whiskey drinkers prefer Scotch (2024 Whiskey Market Report).

- Historical advantages: Scotch established itself in American bars before Prohibition, making it harder for Irish brands to gain ground.

In the EU, Scotch faces 0% tariffs (as it’s also EU-produced), but Irish brands still compete fiercely. However, in the UK, Scotch (now a non-EU product post-Brexit) faces the same TCA rules as Irish whiskey—but Scotch exporters often have larger teams to handle compliance, giving them an edge.

Bourbon and US Whiskey: Domestic Protection vs. Imported Costs

U.S. tariffs on foreign whiskey (including Irish) are low (2.5%), but Bourbon faces no tariffs when sold domestically. That’s a huge advantage.

For example, a Kentucky Bourbon brand sells a $50 bottle in the U.S. with $0 import tax. An Irish brand selling the same bottle in the U.S. pays $12.50 in tariffs (2.5% of $50), forcing them to price it at $62.50 to maintain margins. Even if the Irish whiskey is superior, the price gap can drive consumers to local options.

This “domestic protection” is why Bourbon dominates the U.S. market (85% share), while Irish whiskey holds just 5%.

Canadian and Japanese Whiskey: Global Tariff Benchmarks

Canadian whiskey often享有 lower tariffs due to trade deals. For instance, under CETA (EU-Canada trade agreement), Canadian whiskey enters the EU with 0% tariffs. Irish whiskey, while also EU-produced, faces the same tariffs as Scotch in Canada (5% ad valorem).

Japan is a tough market. It charges 20% ad valorem tariffs on imported whiskey, plus 10% consumption tax. Yet Irish whiskey sales there grew 15% in 2023. How? Brands like Redbreast focus on limited-edition releases, justifying premium prices despite tariffs.

Trade Agreements and Tariff Reduction: Hope for the Industry

While tariffs are tricky, trade deals offer relief. Here’s what’s on the horizon.

Key EU Trade Agreements Impacting Irish Whiskey

The EU’s trade agreements are critical for Irish whiskey exporters:

- CETA (EU-Canada): Since 2017, CETA eliminated tariffs on Canadian whiskey entering the EU—and vice versa. Irish whiskey exports to Canada jumped 25% in 2018, with Jameson leading the charge.

- US-EU T-TIP: Though stalled since 2016, the Transatlantic Trade and Investment Partnership could slash U.S. tariffs to 0%. A 2020 study by the IWA estimated T-TIP would boost U.S. exports by 30%.

- EU-ASEAN Talks: Ongoing negotiations with Southeast Asia could reduce tariffs in countries like Vietnam (current rate: 15%).

The US-Ireland Relationship: Can Tariffs Be Reduced?

The U.S. and Ireland don’t have a bilateral trade agreement, so tariffs follow WTO rules. But Irish whiskey’s popularity (it’s the fastest-growing spirit in the U.S., with 7% annual growth) gives Ireland leverage.

In 2023, Irish Minister for Foreign Affairs, Simon Coveney, stated: “We’re pushing for tariff-free whiskey trade with the U.S. as part of broader trade talks. St. Patrick’s Day alone drives $50 million in Irish whiskey sales there—reducing tariffs would benefit both our economies.”

Regional Blocs: How Smaller Agreements Affect Market Access

Smaller trade blocs matter too:

- Mercosur (South America): Countries like Brazil charge 18% ad valorem tariffs on Irish whiskey. Without an EU-Mercosur deal (stalled since 2019), growth here is slow.

- AfCFTA (Africa): The African Continental Free Trade Area aims to eliminate tariffs by 2030. Irish brands like Midleton are already scouting Nigeria and South Africa, expecting a 20% export boost once tariffs drop.

Strategies to Mitigate Tariff Costs for Irish Whiskey Stakeholders

From distilleries to drinkers, here’s how stakeholders can ease the burden.

Diversify Export Markets to Reduce Risk

Don’t rely on one market. For example, when UK tariffs (via Brexit) hurt sales, brands like Knappogue Castle shifted focus to the Middle East. Their UAE exports grew 40% in 2022, offsetting UK losses.

A 2023 IWA report recommends targeting these low-tariff regions:

- Singapore: 0% tariffs, plus a thriving bar culture.

- South Korea: Post-KORUS agreement (2015), tariffs dropped to 5%, boosting exports by 50% in 5 years.

- Chile: 0% tariffs under EU-Chile trade deal—Irish whiskey sales here rose 25% in 2023.

Set Up Local Production Abroad

Some brands are cutting tariffs by producing whiskey locally. Diageo (owner of Jameson) announced plans to build a $100 million distillery in Kentucky, U.S., to avoid the 2.5% import tariff. While the whiskey won’t be “Irish” (it’ll need U.S. labeling), it’ll let Diageo sell more affordably in America.

But this strategy has downsides. Craft brands worry that “Irish” whiskey made abroad will dilute the brand’s heritage. As Muldoon Distillers’ Seán Muldoon puts it: “Our whiskey’s story is tied to Irish soil and traditions. Local production overseas risks losing that connection.”

Industry Advocacy: The Power of the Irish Whiskey Association (IWA)

The IWA lobbies governments to lower tariffs. In 2022, they successfully negotiated a 5% tariff reduction for Irish whiskey in Australia (from 15% to 10%), leading to a 12% sales spike that year.

How can you help? If you’re a producer, join the IWA. If you’re a consumer, support petitions for fair trade (check the IWA’s website for campaigns).

Optimize Supply Chains to Cut Expenses

Exporters can reduce costs by:

- Bulk shipping: Negotiating lower freight rates with larger orders. A 2024 case study by Irish logistics firm, DHL, found that shipping 10,000 bottles costs 30% less per unit than shipping 1,000.

- Local partnerships: Working with regional distributors to split tariff costs. For example, Irish brand Connemara partnered with a Dubai-based distributor, who absorbed 50% of UAE tariffs in exchange for exclusive sales rights.

What’s Next? Predicting Future Tariff Trends for Irish Whiskey

Experts share their forecasts for tariffs in 2025 and beyond.

Emerging Trade Talks to Watch

- EU-India Deal: If finalized, tariffs on Irish whiskey could drop to 5% (from 10–15%). The IWA estimates this would double exports to India by 2027.

- EU-Australia Talks: Post-2023 negotiations, Australia may cut tariffs to 0% for Irish whiskey, boosting sales in a market where exports grew 18% in 2023.

Political and Economic Factors Shaping Tariffs

Tariffs aren’t just about taxes—they’re political. Rising global protectionism (e.g., the U.S. “Buy American” push) could lead to higher tariffs. Conversely, inflation might force governments to lower tariffs to keep alcohol affordable.

Currency fluctuations also matter. If the euro strengthens against the dollar, the 2.5% U.S. tariff (calculated in euros) becomes costlier for American importers, potentially squeezing margins.

Sustainability and Tariffs: Could Green Efforts Lower Costs?

The EU is exploring “green tariffs,” where products with lower carbon footprints face reduced taxes. Irish distilleries are investing in renewables:

- Bushmills: Installed solar panels, cutting energy use by 20%.

- Tullamore DEW: Uses biogas from local farms to power stills.

If these efforts qualify for exemptions, tariffs could drop by 10–15% for eco-friendly brands. As IWA sustainability lead, Grainne Kennedy, notes: “Green production isn’t just good for the planet—it’s a tariff shield. We’re pushing distilleries to go renewable.”

FAQs About Irish Whiskey Industry Tariffs

Q: What’s the current tariff rate on Irish whiskey imported to the U.S.?

A: As of 2024, the U.S. charges a 2.5% ad valorem tariff on all whiskey imports, including Irish. State taxes (up to 10%) add to this cost.

Q: Did Brexit really increase tariffs on Irish whiskey to the UK?

A: No—tariffs remain 0% under the TCA. But strict rules of origin and customs delays increased costs by 8–12% for non-compliant brands, according to PwC.

Q: Are small distilleries exempt from tariffs?

A: No, but some markets (like the UAE) offer lower tariffs for artisanal products. Check local trade laws—small brands often qualify for “craft” exemptions.

Q: Do tariffs apply to duty-free purchases?

A: Yes, but the retailer (not the consumer) pays tariffs. Duty-free shops often absorb these costs to keep prices competitive, but it depends on the market.

Q: How can I support Irish whiskey despite tariffs?

A: Buy directly from Irish retailers (avoiding tariffs), explore small craft brands, and advocate for tariff reductions via the IWA’s consumer campaigns.

Conclusion: Tariffs, Trade, and the Future of Irish Whiskey

Irish whiskey’s global success hinges on navigating tariffs. From historical battles with Scotch to modern Brexit challenges, trade costs have always shaped the industry—but so too have clever strategies. By diversifying markets, advocating for better trade deals, and leaning into sustainability, distilleries can turn tariffs from a barrier into a motivator.

For consumers, understanding tariffs helps you appreciate the effort behind your favorite bottle. Next time you pour a Jameson or savor a Redbreast, remember: That smooth flavor comes with a story—and sometimes, a tax.

Internal Links for Further Reading:

- Learn how trade deals reshape alcohol markets: “Global Trade Agreements and Their Impact on Spirit Exports”

- Dive into Irish whiskey’s revival: “From Decline to Boom: The Modern Irish Whiskey Renaissance”